One of the key roles for any mortgage adviser is to source and give you advice on the best mortgage option.

Other key roles include getting the mortgage approved, and getting competitive interest rates.

What do we mean when we people which is the best mortgage option?

As a mortgage adviser I often see people choose their mortgage for reasons such as:

- It’s the bank they already have bank accounts with

- It’s the first or fastest bank to approve their mortgage

- It’s the bank advertising the lowest interest rate

Now these might seem like good reasons to choose a mortgage, but there is more to getting the best mortgage option – the “best” mortgage may include some of these but should also give you the maximum flexibility and save you money in the long term?

The best mortgage option may differ from person to person.

In general I would say that you should make sure that you can pay extra onto the fixed loans so that you can pay the loans off faster when you can, but without changing the underlying loan term as that can cause unwanted financial pressure when interest rates increase.

I would say that the best mortgage option in most cases would be the TSB Bank options which offer fixed home loans that are very flexible and also very competitively priced.

If we think about the reasons that you might have used to choose a mortgage.

# 1: Using The Bank You Know

If you want a mortgage then it is easy to approach the bank that you know, and given they have access to your banking records and already have you set up in the banks systems it can be easier (and quicker) for them to review your application and approve a mortgage.

But how do you know that this bank offers the best mortgage option?

You probably don’t, but many Kiwis are just happy to get a mortgage approved, and feel that “their bank” has looked after them well. If you don’t know what makes a good mortgage then it’s easy to think that they are all basically the same, and typically the bank will not tell you any differently. At best, the person at the bank will tell you about the features that the mortgage they have might offer and to most people it may seem quite good.

# 2: Who Approves Your Fast

When you are buying a house you may need the mortgage and with pressure from the real estate agent you may need it approved as quickly as possible. You may approach a few banks or use a mortgage broker (adviser) to arrange a mortgage and given speed is an issue you may be happy just to get an approval in time.

You are probably not even really focused on the mortgage – instead you have fallen in love with the new home and will do whatever it takes to make sure that you can buy it. This is especially the case for first home buyers and when the deposit is a bit limited.

Over the years we’ve seen that most people are happy to have an approval and will go with the bank that approved them first. Unfortunately that means they miss out on a better mortgage, because we also know that the banks that can offer what is the best mortgage type to have will also generally be busier and therefore slower than a bank that has just an okay mortgage type.

As a mortgage adviser I would say that it’s always best to try for the best mortgage first and if needed you need to be prepared to wait a bit to get it approved.

# 3: The Lowest Interest Rate

There is a reason that banks advertise a special low interest rate, and it’s to get more “new” business.

Banks that offer special rates often pick a specific fixed loan term so they can lock borrowers in for that period, and they know that most people will then stay with the bank. When that fixed term ends most people will just refix again without taking much notice of the interest rate as long as it’s okay.

Knowing that you have the lowest rate seems important at the time, but no bank will always have the lowest interest rates and therefore it’s more important to know that the bank you are with will consistently have competitive mortgage rates across the range of fixed terms that are offered.

If you are using a mortgage adviser to refix your interest rates then they should also be making sure that they keep the bank honest and see if they can get the bank to match any lower rates that may be being offered. We welcome people to contact us and we do this for free regardless if we arranged the mortgage or not.

Most banks in New Zealand offer similar home loan interest rates with a few that try to offer the lowest home loan interest rates by at least a small margin. Bank of China generally offers the lowest home loan interest rates, but the loans are not as flexible as some other banks. TSB Bank is a New Zealand owned bank and generally offers a very competitive home loan interest rate trying always to remain lower than the big four Australian owned banks; ANZ, ASB, BNZ and Westpac.

I’d Suggest These Key Considerations

We all know that a mortgage is a big financial commitment – most are large in size and something that you will be paying off for a long time.

A mortgage is often a families biggest financial commitment with the average mortgage in New Zealand reported as being $362,553 but with first home buyers being even more at $567,782 (Canstar – January 2023)

Those are big numbers, but what shocks most people is how much they will end up paying for the mortgage over the lifetime of the loan.

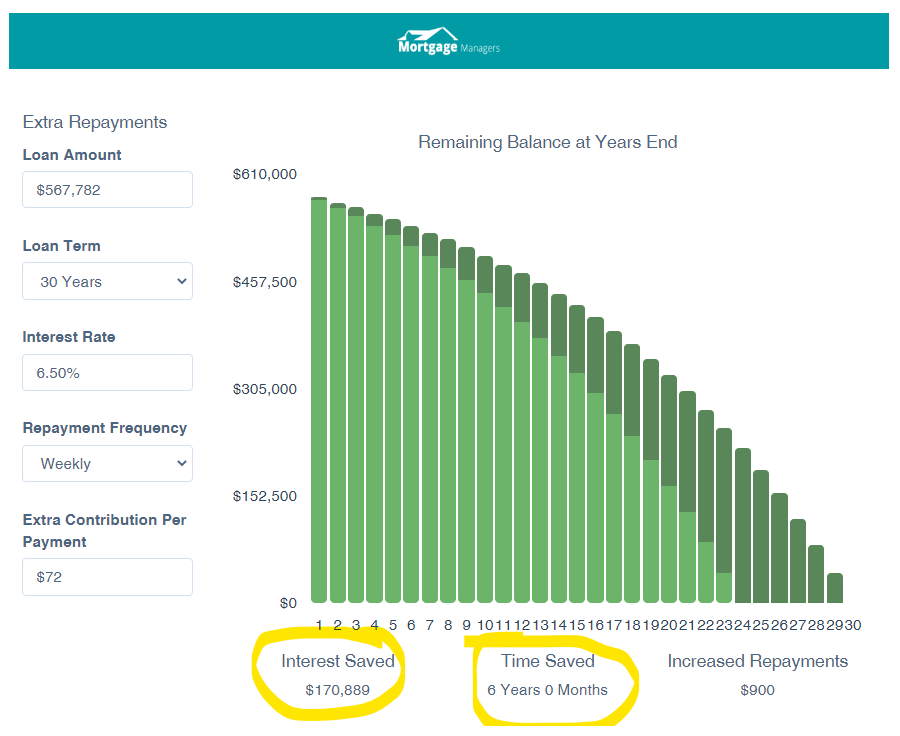

Example: Average First Home Buyer $567,782 (30-Years @ 6.50%)

If you are a first home buyer and have the average home loan ($567,782) then using the interest rate of 6.50% means that your weekly repayments would be $828 and over the 30-years you would pay the bank a total of $1,291,348

The bank are going to make a lot of money from having you as a home loan customer, and that’s before you use any other bank products.

But as the graph below shows, if you can increase your repayments by just $72 a week you will pay your home loan off 6-years faster and save over $170,000

It makes sense to have a mortgage that allows you to pay your mortgage off faster as this is what really saves you money. Everyone with a home loan should have this explained to them and they should make sure that they have regular meetings or discussions to ensure that they are not paying the bank too much.

- Will your bank show you how to pay them less? Unlikely!

- Will your mortgage adviser show you how to save money? Maybe some do, but that’s exactly what we do.

Just using a bank that that you know and feel comfortable is not going to mean that you have the best mortgage type as that bank may not have access to that mortgage. The bank that approved you fastest will probably not show you how to save what you pay the bank, as it’s unlikely that they have the best mortgage – otherwise they would be too busy to be the fastest. If you went with the bank that had the lowest interest rate it can look okay in the first year or two, but generally banks offer special rates when they need more business ands those good interest rates rarely last.

The best mortgage option is a loan that offers flexibility so that you can manage the loans as your circumstances change over time and yet gives you the ability to pay the loans off faster in those periods when you can.

The Features Your Mortgage Should Have

When trying to establish what is the best mortgage type to have you need to consider what you want with your mortgage, and for the purposes of this article we will assume that you want to be able to pay it off as fast as you can and save a huge amount too.

We are talking about a mortgage on your home here – your goal may be different with a mortgage on an investment property, a mortgage used for business or when you never plan to have the property or mortgage for any length of time. We are also not talking about bridging finance or when specialist finance is needed.

Here are the key features that your home loan should at least have:

- Revolving Credit Facility – when used properly these can be used as the main loan funding facility. It does not need to have a large limit, but it gives you the control of the loans and flexibility to adjust the repayments, the ability to save a fund lump-sum repayments and also to build up a back-stop. These facilities are great for pre-planning for a change in your financial situation like starting a family, returning to education or training and a change in jobs or careers.

- Fixed Loans – the interest rates are almost always lower on a fixed loan and the nature of being “fixed” gives the comfort and ability to budget. Most people want to have most of their lending on fixed rates for these reasons and it’s always best to split up your mortgage into two, three or more fixed loans too as that gives added flexibility.

- Ability to Increase Repayments – with all home loans you can increase the repayments when your loans are at the floating rate (higher rate) but there are less options when you select a fixed rate. Almost all banks allow you to increase your repayments on fixed loans, but many are quite limited. Some will limit you to ‘say’ 5% of the total mortgage, or $15,000 per year but what you want is a mortgage type that allows you to increase each loan by ‘say’ $1,000 a month so if you have your mortgage split into five loans you have five opportunities to increase the repayments to a total of $5,000 a month extra which is $60,000 per year.

- Increase Repayments Without Shortening Loan Terms – unfortunately with most banks when you increase any repayments by default the bank shorten the loan term. This sounds fine at first, but a mortgage is a long-term commitment and things will change over time so you will not want to be forced into a situation when you need to make larger repayment’s because of this. Specifically if interest rates increase, or your income reduces – both of these are quite common and cause a lot of issues.

- Ability to Decrease Repayments – while it’s good to be able to increase repayments on a fixed loan, having the ability to decrease the repayments as well gives people the confidence to do increases beyond what they may have done otherwise. This alone can mean you will end up doing larger increases and therefore save more.

The banks have other features too that they promote, and some are useful too. The features listed here are the main and arguably the most important features that will help you save the most on your mortgage.

So How Can I Help You?

I work with a group of mortgage advisers at Mortgage Managers and we continuously research the options that the banks offer and can make sure that you know what are the best mortgage options and which banks offer them.

I can help you arrange to refinance your mortgage so that you benefit from having the best mortgage options.

It will cost you nothing for me to do this for you as the banks pay me.

If you contact me today I can help you refinance so you can start getting your mortgage paid off sooner.

2 Responses